In a historic move that reshapes the global technology landscape, Elon Musk has officially merged his artificial intelligence startup, xAI, into SpaceX. The deal, confirmed this week, creates a combined entity valued at a staggering $1.25 trillion, positioning it as the world's most valuable private company. This strategic consolidation brings Musk’s aerospace engineering and advanced AI capabilities under one roof, setting the stage for a record-breaking $50 billion initial public offering (IPO) anticipated later this year.

The Architecture of the Deal

The all-stock transaction values xAI at approximately $250 billion, while SpaceX’s valuation has been marked up to $1 trillion. Under the terms of the agreement, xAI investors will receive SpaceX stock, effectively integrating the AI firm's financial structure with the profitable aerospace giant. This move comes just weeks after reports surfaced that xAI—the creator of the Grok chatbot—was burning through nearly $1 billion a month to fuel its massive compute infrastructure.

By absorbing xAI, SpaceX not only secures the AI startup's future but also creates a vertically integrated "innovation engine" capable of dominating both orbital logistics and artificial intelligence. The merger also simplifies Musk’s complex web of companies, with Tesla’s recent $2 billion investment in xAI now converting into a direct stake in the combined SpaceX-xAI powerhouse.

Orbital Data Centers: The Future of AI in Space

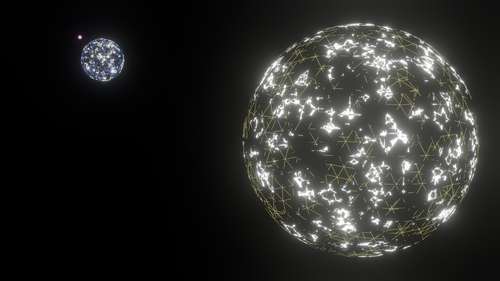

The driving force behind this SpaceX xAI merger is Musk’s ambitious vision for "orbital data centers." In a blog post announcing the deal, Musk argued that the energy and cooling constraints of Earth-based data centers are becoming a bottleneck for AI development. His solution? Launching massive constellations of AI-dedicated satellites that can harness unfiltered solar energy in space.

"In the long term, space-based AI is obviously the only way to scale," Musk stated. The plan involves deploying up to one million satellites equipped with high-performance AI compute hardware, powered by the sun and connected via Starlink’s low-latency laser mesh network. This infrastructure would theoretically allow Grok to scale exponentially without taxing Earth’s power grids, giving SpaceX a unique advantage over terrestrial rivals like Google and OpenAI.

Starlink AI Integration

Immediate synergies are expected between Starlink and xAI’s software. Engineers are reportedly already working on integrating Grok’s reasoning capabilities into Starlink’s network management, allowing for autonomous optimization of satellite constellations. Furthermore, the merger places the social media platform X (formerly Twitter), which is owned by xAI, under the SpaceX umbrella, potentially leveraging Starlink for a new decentralized internet protocol.

Fueling the $50 Billion Capital Raise

Financial analysts view the merger as a prelude to what could be the largest IPO in history. SpaceX is targeting a capital raise of up to $50 billion in its upcoming public listing. The narrative of a combined hardware-software juggernaut—building rockets, managing global internet, and training the world's most powerful AI—is expected to drive immense investor demand.

"This is the 'Muskonomy' fully realized," notes tech analyst Sarah Jenkins. "By folding the capital-intensive xAI into the cash-generating machine that is SpaceX, Musk solves xAI's burn rate problem while giving SpaceX a growth narrative that goes beyond launch contracts. It transforms SpaceX from a transportation company into a planetary computing infrastructure provider."

Risks and Autonomous Space Exploration

While the vision is grand, the risks are equally high. Critics point out that merging a profitable aerospace contractor with a cash-burning AI startup could strain SpaceX’s balance sheet. However, the long-term play focuses on AI in space exploration. As SpaceX prepares for uncrewed missions to Mars aboard Starship, advanced autonomous AI will be critical for navigation, habitat management, and resource extraction on the Red Planet.

With this merger, Musk has effectively bet his entire empire on the belief that the future of intelligence lies among the stars. As the combined entity prepares for its public debut, the world is watching to see if this $50 billion gamble will launch humanity into a new era of AI-powered spacefaring.