The first week of February delivered a brutal reality check to retail traders in the prediction markets, while offering a masterclass in "Theta Decay" for the sophisticated "smart money." As geopolitical premiums regarding Iran evaporated overnight, millions of dollars in wealth transferred from those trading on emotion to those trading on mathematics.

Simultaneously, liquidity is rotating aggressively. Capital is fleeing the stagnant geopolitical sector and finding new alpha in Technology (AI release dates), Macroeconomics (Fed policy divergence), and, most notably, the massive liquidity injection event known as Super Bowl LX.

Below is the comprehensive breakdown of the week’s smart money flows, the structural arbitrage opportunities currently available, and the critical watchlist for the week ahead.

The Big Short: Anatomy of a Wipeout

The Contract: Will US strike Iran by Jan 31?

The Outcome: Expired "No" ($0.00).

The Setup:

Late January was characterized by a surge in geopolitical anxiety. News cycle intensity regarding the Middle East drove retail capital into the "Yes" contracts, pushing the price as high as 35¢ (implying a 35% probability of a strike). In financial terms, this was a classic "Fear Trade"—buying insurance against chaos.

The Mechanics of the Collapse (Theta Decay):

For professional traders, this contract offered a textbook arbitrage opportunity based on Time Decay (Theta).

In a binary prediction market, a contract bound by a specific date (Jan 31) loses value every second that passes without the event occurring. Even if the political tension remains high, the probability of an event within the remaining timeframe shrinks mathematically.

By January 29th, despite headlines remaining alarmist, the "No" side of the trade became a mathematical fortress. Sophisticated traders sold "Yes" positions or bought "No" cheaply, essentially acting as "The House." They understood that military logistics take time, and the window for action was closing faster than the news cycle could keep up.

The Result: On Friday midnight, the contract expired. "Yes" holders were wiped out completely, losing 100% of their capital. The "No" holders collected the full premium, proving once again that in prediction markets, the clock is often a more powerful indicator than the news ticker.

Sector Watch: The Return of the "AI Rumor Mill"

The Contract: GPT-5 Release Date: H1 2026?

The Trend: Bullish Accumulation (Up 12% DoD).

The Sentiment Analysis Strategy:

After a quiet Q4 2025, volume has returned to the Artificial Intelligence sector. Unlike political markets, which are often binary and event-driven, tech-roadmap markets are driven by Sentiment Analysis.

Traders in this sector are currently deploying scripts to scrape "Silicon Valley Twitter" (X), analyzing leaks regarding OpenAI’s compute capacity and beta-testing logs.

The "Buy the Rumor" Dynamic:

The "Yes" shares have rallied 12% this week, pricing in a 40% probability of a major model release before June. This is a significant divergence from Wall Street equity analysts, who are forecasting a Q3/Q4 timeline for major AI revenue impacts.

Prediction markets are effectively front-running the equity markets here. If the prediction market probability crosses 60%, expect to see a correlated bump in NVIDIA and Microsoft stock prices shortly after, as traditional algorithms pick up on the signal generated by the crowd.

Macro-Economics: The "Hawkish" Divergence

The Contract: Fed Interest Rate Cut in March 2026?

The Spread: Prediction Markets (45%) vs. CME Futures (60%).

The Arbitrage Opportunity:

We are currently witnessing a rare and fascinating divergence between two massive pools of capital:

* CME FedWatch (Traditional Wall Street): Pricing a 60% chance of a cut, largely based on banking models and historical precedent.

* Polymarket (The Crowd): Pricing only a 45% chance, signaling a belief that inflation data will remain "sticky."

Why This Matters:

Historically, prediction markets have reacted faster to consumer-level inflation signals than institutional models. The "Crowd" feels price hikes at the grocery store before they show up in the CPI (Consumer Price Index) data.

The Trade: If you believe the Fed will indeed cut rates, buying "Yes" on Polymarket at 45¢ is mathematically superior to buying futures contracts, offering a higher potential ROI due to the mispricing. Watch this spread closely; if Polymarket starts trending toward 60¢, it is a leading indicator that the "sticky inflation" narrative is breaking.

Watchlist for Next Week: The "Alpha" Report (Feb 3 – Feb 9)

While the general market watches the headlines, the "smart money" in prediction markets is positioning itself for four high-variance events in the coming week.

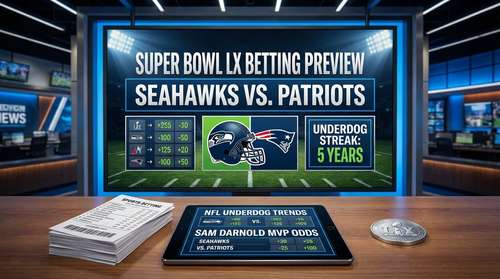

The "Super Bowl LX" Liquidity Event (Feb 8)

For prediction markets, the Super Bowl is not a game; it is a Liquidity Injection Event. It brings casual users (retail liquidity) into the ecosystem, creating inefficiencies that professionals can exploit. The "Winner" market (Seahawks vs. Patriots) is too efficient to offer real edge. The alpha lies in the Exotic Prop Markets:

* The Halftime Show Arbitrage: Traders are heavily buying contracts that Bad Bunny will open the halftime show. This isn't a guess; it's data. Traders are tracking real-time Spotify streaming spikes in the host city and analyzing flight logs of private jets. The market is pricing this early, front-running the official setlist leaks.

* The "Gatorade Color" Index: Currently, Orange is trading at a premium (+210 implied odds). This seems random to the uninitiated, but "quants" are trading on a dataset spanning 30 years. Historical data indicates that winning coaches in domed stadiums (like this year's venue) are doused with Orange Gatorade 35% of the time. This is where absurd trivia meets hard financial modeling.

* National Anthem Duration: The market for "Over/Under 120 seconds" is seeing heavy volume. Traders are not listening to the song; they are analyzing YouTube clips of the singer's past 10 live performances to calculate their average cadence and breath control. If the average is 124 seconds, buying the "Over" at 120 is a statistical edge.

Bitcoin’s "Bearish Divergence"

* The Contract: Bitcoin > $65k by end of Feb?

* The Signal: Bearish.

While Spot Bitcoin ETFs on Wall Street are holding steady near $76,000, prediction markets have turned surprisingly dark. There is over $1 million in volume betting that Bitcoin will break below $65,000 this month.

Currently, the market signals a 72% probability of a crash or significant correction. This diverges wildly from the optimistic consensus on Crypto Twitter. If you hold crypto assets, this prediction market is your "canary in the coal mine." The crowd is putting real money behind a crash thesis—ignore it at your peril.

The "Meta-Market": The Platform War

* The Contract: Polymarket vs. Kalshi: Who wins Feb Volume?

A fascinating "Civil War" trade has emerged where users are betting on the platforms themselves.

The Catalyst: Jupiter, a major aggregator on the Solana blockchain, integrated Polymarket directly into its interface this week.

The Trade: Traders are buying "Polymarket" stock heavily, betting that this UI integration will unleash a flood of retail Solana users that the regulated, US-based competitor Kalshi cannot match. This is a bet on UX distribution winning over Regulatory approval.

Weather Derivatives: The "Hottest Month" Trade

* The Contract: Feb 2026: Hottest on Record?

* The Play: Pure Data Arbitrage.

This market is currently pricing a 46% chance that February 2026 will set a new global heat record.

How the Pros Trade It: They don't look out the window. They run scripts that scrape daily raw data from NOAA (National Oceanic and Atmospheric Administration) and satellite telemetry.

If you see a heatwave forecast forming in the Southern Hemisphere (which drives global averages during this season), this contract is undervalued. The "pros" buy the contract before the heatwave hits the mainstream news cycle. By the time CNN reports "Record Heat in Australia," the contract price will have already jumped to 80¢, and the smart money will be selling for a profit.

The Future of Information

This week’s activity underscores the transformation of prediction markets from a novelty into a sophisticated asset class. We saw the destruction of emotional trading in the Iran markets and the triumph of data-driven strategies in the Super Bowl and Weather sectors.

As we move deeper into 2026, the question is no longer "do these markets work?" The question is: Are you trading the news, or are you just reading it?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Prediction markets carry a high level of risk.