In a watershed moment for the global technology sector, the United States and Taiwan have officially inked a historic U.S.-Taiwan trade agreement 2026, cementing a partnership that promises to reshape the global semiconductor supply chain. Announced by the Department of Commerce on Thursday, the pact slashes reciprocal tariffs to 15 percent and secures a staggering $250 billion in direct investment from Taiwanese firms into American soil. At the heart of this deal is a massive acceleration of TSMC Arizona expansion plans, with the chipmaking giant now eyeing a roadmap to operate up to 11 manufacturing facilities in the Phoenix area.

A Historic Shift in Semiconductor Reshoring

The agreement marks the culmination of months of intense negotiations led by Howard Lutnick, Commerce Department Secretary, and Taiwanese Vice Premier Cheng Li-chiun. Under the terms of the deal, Taiwan has committed to a baseline of $250 billion in direct investments focused on the U.S. semiconductor, energy, and artificial intelligence sectors. Additionally, the Taiwanese government will provide another $250 billion in credit guarantees to support supply chain partners moving stateside.

Secretary Lutnick, speaking to CNBC, emphasized the administration's aggressive goals for semiconductor reshoring. "We're going to bring it all over so we become self-sufficient in the capacity of building semiconductors," Lutnick stated, outlining a target to migrate 40 percent of Taiwan's chip production capacity to the United States. This move is designed to insulate the U.S. economy from geopolitical shocks while securing the hardware necessary for the booming AI revolution.

TSMC Arizona Expansion: The 11-Fab Gigafab Cluster

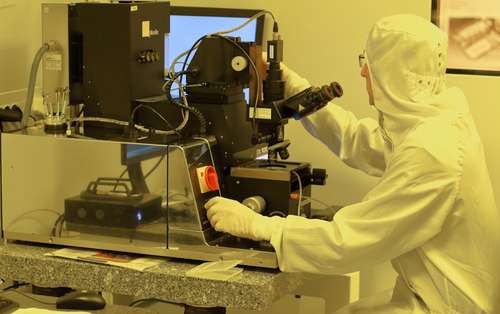

The most ambitious component of the deal involves Taiwan Semiconductor Manufacturing Company (TSMC). Already constructing a major hub in Arizona, the new trade framework has unlocked plans for a "gigafab" cluster of unprecedented scale. Sources confirm that TSMC is now plotting a roadmap to expand its footprint to 11 manufacturing facilities—a significant leap from the six previously projected.

This TSMC Arizona expansion is expected to drive the company's total U.S. investment potential toward $465 billion over the next decade. The new facilities will focus on the most advanced process nodes, specifically catering to AI chip manufacturing investment demands from American tech titans like Nvidia and Apple. By situating these advanced capabilities on U.S. soil, the deal aims to close the vulnerability gap in the supply of high-performance computing chips.

Infrastructure and Workforce Challenges

Scaling to 11 fabs presents logistical hurdles, from water rights in the desert southwest to skilled workforce availability. However, the agreement includes provisions for expedited permitting and federal support to fast-track construction. TSMC has reportedly already acquired an additional 900 acres of land adjacent to its existing North Phoenix site to accommodate this massive build-out.

Understanding the 15 Percent Reciprocal Tariffs

For American businesses and consumers, the immediate impact of the deal lies in the tariff restructuring. The agreement establishes a ceiling of 15 percent reciprocal tariffs on Taiwanese imports, down from the previous 20 percent rate. Crucially, negotiators agreed to a "no stacking" provision, meaning these tariffs will not be added on top of existing Most-Favored-Nation (MFN) duties.

This reduction places Taiwan on equal footing with other major U.S. trade partners like Japan and South Korea. The deal also grants Taiwanese semiconductor products the most favorable treatment under Section 232 of the Trade Expansion Act, effectively creating a "green lane" for the critical components needed to power U.S. data centers and defense systems. In exchange, U.S. exports to Taiwan will enjoy similar preferential access, deepening the economic integration between the two democracies.

Securing the Future of AI and Defense

The strategic implications of this deal extend far beyond economics. By anchoring a significant portion of the global semiconductor supply chain in North America, the U.S. is effectively hedging against potential instability in the Taiwan Strait. The $250 billion investment injection is widely seen as a "silicon shield" 2.0, binding the U.S. and Taiwan closer together through shared critical infrastructure.

As the construction cranes multiply across the Arizona horizon, this agreement signals a definitive end to the era of offshore reliance for critical technology. With the U.S.-Taiwan trade agreement 2026 now in force, the race to build the western world's premier chip manufacturing hub has officially begun.