At the 2026 World Economic Forum in Davos, NVIDIA CEO Jensen Huang delivered a seismic forecast that has reshaped market expectations: the global artificial intelligence revolution will necessitate an infrastructure buildout exceeding several trillion dollars. Addressing a packed audience of global leaders and tech titans, Huang described the current phase of AI development as merely the opening act of the "largest infrastructure project in human history." This bold projection immediately reverberated through global financial markets, igniting a fresh semiconductor stock rally 2026 that sent key indices and industry giants to unprecedented heights.

Trillion-Dollar AI Revolution: The "Five-Layer Cake"

During his keynote, Huang demystified the complexity of the AI ecosystem by comparing it to a "five-layer cake." This analogy has become the central talking point of Davos 2026, offering a roadmap for where the trillions in capital expenditure will flow over the coming decade.

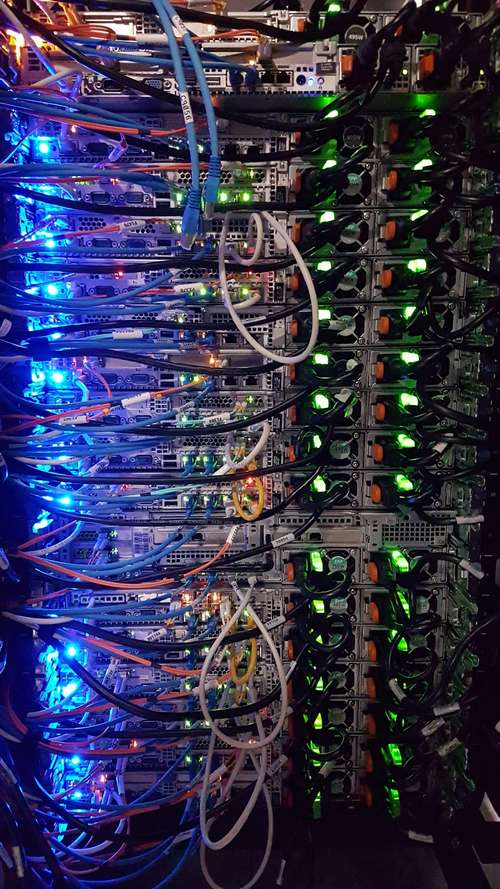

According to Huang, the foundational layer is energy, followed by chips, cloud infrastructure, AI models, and finally, applications. "We are now a few hundred billion dollars into it," Huang noted, emphasizing that the industry is still in its infancy. He argued that as nations and corporations race to establish "Sovereign AI"—the capacity to train and run models on their own infrastructure—the demand for data centers, specialized energy grids, and advanced logic chips will skyrocket. This "Sovereign AI" concept urges countries to treat AI infrastructure as critically as they do roads, electricity, and telecommunications.

Samsung Hits Record High as Semiconductor Stocks Rally

The market's response to Huang's bullish outlook was immediate and electric. Investors, reassured that the AI boom is far from a bubble, poured capital into hardware suppliers essential to this infrastructure overhaul. Samsung Electronics surged to an all-time high, breaking past 136,000 KRW, driven by renewed optimism over its high-bandwidth memory (HBM) supply deals with NVIDIA and upbeat comments from co-CEO Jun Young Hyun regarding the company's AI prospects.

Philadelphia Semiconductor Index Breaks Records

The enthusiasm wasn't limited to a single company. The Philadelphia Semiconductor Index (SOX) shattered previous ceilings, climbing above the 8,000-point mark for the first time in history. This broad-based rally confirms that Wall Street views the global AI infrastructure buildout as a secular trend that will drive earnings for years to come. Analysts at Davos noted that while software and applications garner headlines, the immediate financial windfall belongs to the "pick-and-shovel" providers building the physical backbone of the AI age.

Global AI Infrastructure: The Energy Bottleneck

A critical component of Huang's forecast focused on the physical constraints of this digital revolution: energy. As AI models grow exponentially in size and complexity, their power requirements are outpacing current grid capabilities. Huang's discussion highlighted a pivot toward sustainable and dedicated energy solutions for data centers.

Major tech firms are now expected to invest heavily not just in GPUs, but in the power plants required to run them. This aligns with recent trends where hyperscalers are partnering with nuclear and renewable energy providers to secure 24/7 baseload power. For investors, this signals a widening of the AI trade beyond pure tech stocks into utilities and industrial infrastructure companies capable of upgrading the world's aging power grids to support the 2026 AI ecosystem.

Market Trends 2026: Beyond the Hype

As the World Economic Forum concludes, the takeaway for 2026 is clear: the "AI bubble" narrative is being dismantled by tangible, massive-scale capital commitments. Gartner's recent forecast aligns with Huang's vision, predicting global AI spending will top $2.5 trillion by the end of the year. The focus has shifted from experimental chatbots to industrial-grade implementation, where reliability, security, and sovereignty are paramount.

For investors and industry watchers, the message from Jensen Huang is a call to action. The infrastructure phase of the AI revolution is underway, and the window to capitalize on the foundational buildout is open. Whether it's through semiconductor manufacturing, energy solutions, or data center construction, the trillion-dollar surge is no longer a prediction—it is the defining economic reality of 2026.